ING

ING

Category

Finance

| Technical Specification | Download | |

|---|---|---|

| Latest Updated | May 28, 2024 | |

| Latest Version | 3.0.63 | |

| Developer | ||

| Operating system | Android, iOS | |

| Language | English | |

| Price | Free | |

| Available version | 3.0.63 | |

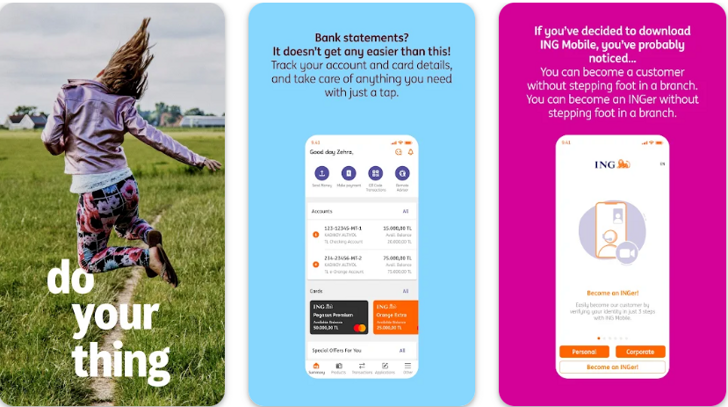

- The ING mobile application is a user-friendly banking app that allows customers to conveniently manage their finances on the go. With features such as checking account balances, transferring funds, paying bills, and setting up savings goals, users can easily stay on top of their financial obligations. Additionally, the app provides real-time notifications for account activity and offers personalized insights to help users make better financial decisions. With ING, users can enjoy the convenience of banking at their fingertips, leading to a more organized and efficient approach to managing their money.

More Details

- Below are some of the notable features of the app:

- Real-Time Banking Transactions: This feature allows users to monitor and manage their bank accounts with real-time updates on all transactions. It is especially useful for keeping track of expenditures, deposits, and ensuring no unauthorized transactions occur. The seamless integration with financial networks ensures accuracy and speed in the reflection of account activities.

- Customizable Financial Goals: Users can set and customize their financial goals, be it saving for a new home, preparing for retirement, or setting aside funds for an emergency. This feature provides tools to track progress, adjust plans, and receive predictive analysis based on spending habits and income. It's a powerful tool for personal financial planning and encourages a disciplined approach to managing money.

- Enhanced Security Protocols: The app employs state-of-the-art encryption and multi-factor authentication to protect user data and financial information. These security measures are crucial in preventing unauthorized access and safeguarding user privacy in an increasingly digital world. Regular updates ensure the app stays ahead of potential security threats.

- Integrated Expense Tracker: This functionality helps users manage their daily expenses more efficiently. By categorizing expenses and providing insightful spending reports, users can identify areas where they can cut costs or redistribute their budget. The integration with notifications also means users can be alerted about unusual spending patterns or when they’re nearing set budget limits.

Extra Details

- How to uninstall the ING? You can uninstall ING on your mobile device by following these steps: Locate setting icon on your phone. Tap Application manager or Apps Touch ING. Press uninstall.

How to install the application

- How to download and install ING on your mobile device? The steps below explain how you can download the app on Google Play

- Launch Google Play on your Android device * Input ING in the search bar * Touch the most relevant search result * Tap Install to download the app * Wait for the process to complete.

DISCLAIMER

- The above app is a mobile app that will not change any system settings on your phone

- All apk files downloaded from our site are secure

- We provide the official download link from Google Play Store

- The trademarks and logos of all the merchants displayed on the website are the property of their respective owners. The website is not affiliated or associated with any of them

- Our website and its content strictly comply with all the terms and conditions of Google Ads Advertising policies and Google Unwanted Software policy

Steps to Uninstall android App

- How to uninstall the ING? You can uninstall ING on your mobile device by following these steps: Locate setting icon on your phone. Tap Application manager or Apps Touch ING. Press uninstall.

Steps to Uninstall App on Apple devices

To remove ING from your iOS device, follow these instructions:?

- Navigate to your Home Screen or App Library and find the ING icon.

- Tap and hold the icon until a menu appears.

- Choose the option labeled Remove App.

- Confirm the removal by selecting Delete App.

- Finish by tapping Done or pressing the Home button.

Tips & Tricks

- Set up savings goals: Use the 'Goals' feature to set specific financial goals, whether it's for a vacation, a new car, or an emergency fund. This will help you track your progress and stay motivated to save.

- Enable notifications: Stay on top of your finances by enabling push notifications for transaction alerts, upcoming bills, and account balances. This will help you avoid missed payments and stay within budget.

- Use Round-Ups: Activate the Round-Ups feature to automatically save spare change from your transactions by rounding up to the nearest dollar. This effortless way of saving can add up over time and help you reach your financial goals faster.

- Analyze spending patterns: Utilize the 'Spending Analysis' tool to see where your money is going each month. This can help you identify areas where you can cut back and save more effectively.

- Monitor credit score: ING provides tools to monitor your credit score and offers tips on how to improve it. Keeping an eye on your credit score can help you qualify for better loan rates and financial opportunities in the future.