Revolut

Revolut

Category

Finance

| Technical Specification | Download | |

|---|---|---|

| Latest Updated | May 28, 2024 | |

| Latest Version | 10.30.2 | |

| Developer | ||

| Operating system | Android, iOS | |

| Language | English | |

| Price | Free | |

| Available version | 10.30.2 | |

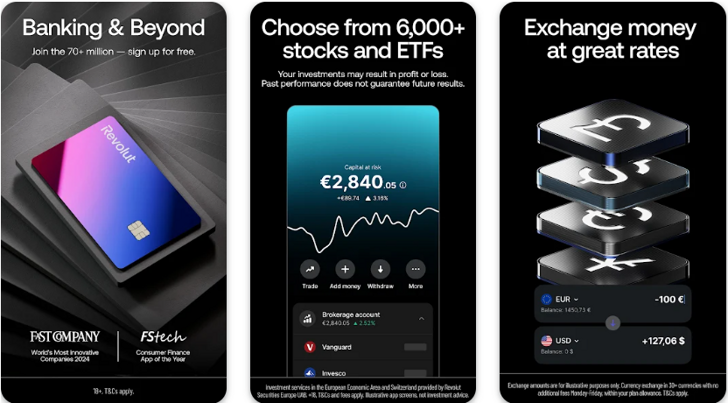

- Revolut is a cutting-edge mobile banking app that offers a wide range of financial services tailored to modern lifestyles. With Revolut, users can easily manage their money, make international transfers at competitive exchange rates, and track their spending in real time. The app provides users with the ability to set up budgets, split bills with friends, and even invest in stocks and cryptocurrencies. What sets Revolut apart is its focus on convenience and cost-effectiveness, making it an ideal solution for users looking for a versatile and user-friendly banking experience. Experience the future of banking with Revolut today.

More Details

- Below are some of the notable features of the app:

- Global Spending and Currency Exchange: Revolut enables users to spend money globally without the burden of high foreign exchange fees. The app supports transactions in over 150 currencies with the exchange rate provided in real-time, making it an indispensable tool for travelers and digital nomads. This feature is enhanced by the ability to hold and exchange multiple currencies within the app, ensuring seamless spending while abroad.

- Budgeting and Analytics: The app provides robust budgeting tools that help users manage their finances effectively. Users can set monthly spending budgets and get instant spending notifications, which helps in tracking expenses against these budgets. Additionally, the analytics tool breaks down spending by category (such as groceries, utilities, and dining out), helping users gain detailed insights into their financial habits and make informed decisions to optimize their financial health.

- Cryptocurrency Exchange: Revolut extends its services to the modern cryptocurrency market, allowing users to buy, hold, and sell cryptocurrencies like Bitcoin, Ethereum, Litecoin, and others directly through the app. This functionality is designed with security and simplicity in mind, offering an easy entry point for users new to cryptocurrency and providing advanced options for seasoned traders. These features are designed to make financial management both intuitive and comprehensive, catering to the needs of a globally mobile and financially engaged user base.

Extra Details

- How to uninstall the Revolut? You can uninstall Revolut on your mobile device by following these steps: Locate setting icon on your phone. Tap Application manager or Apps Touch Revolut. Press uninstall.

How to install the application

- How to download and install Revolut on your mobile device? The steps below explain how you can download the app on Google Play

- Launch Google Play on your Android device * Input Revolut in the search bar * Touch the most relevant search result * Tap Install to download the app * Wait for the process to complete.

DISCLAIMER

- The above app is a mobile app that will not change any system settings on your phone

- All apk files downloaded from our site are secure

- We provide the official download link from Google Play Store

- The trademarks and logos of all the merchants displayed on the website are the property of their respective owners. The website is not affiliated or associated with any of them

- Our website and its content strictly comply with all the terms and conditions of Google Ads Advertising policies and Google Unwanted Software policy

Steps to Uninstall android App

- How to uninstall the Revolut? You can uninstall Revolut on your mobile device by following these steps: Locate setting icon on your phone. Tap Application manager or Apps Touch Revolut. Press uninstall.

Steps to Uninstall App on Apple devices

To remove Revolut from your iOS device, follow these instructions:?

- Navigate to your Home Screen or App Library and find the Revolut icon.

- Tap and hold the icon until a menu appears.

- Choose the option labeled Remove App.

- Confirm the removal by selecting Delete App.

- Finish by tapping Done or pressing the Home button.

Tips & Tricks

- Use the 'Vaults' feature to set aside money for specific savings goals, like a vacation or a new gadget. This helps you stay disciplined and organized with your finances.

- Take advantage of the 'Analytics' section to track your spending habits and identify areas where you can cut back. This feature provides valuable insights to help you budget effectively.

- Enable 'Round-Ups' to automatically save spare change from your everyday transactions. This small but consistent saving method can add up over time and help you reach your financial goals faster.

- Utilize the 'Split Bill' feature to easily divide expenses with friends and family. This eliminates the hassle of manually calculating who owes what, making it convenient for group payments.

- Set up 'Budgets' to establish spending limits for different categories, such as groceries or entertainment. This feature helps you stay on track and avoid overspending in specific areas of your budget.